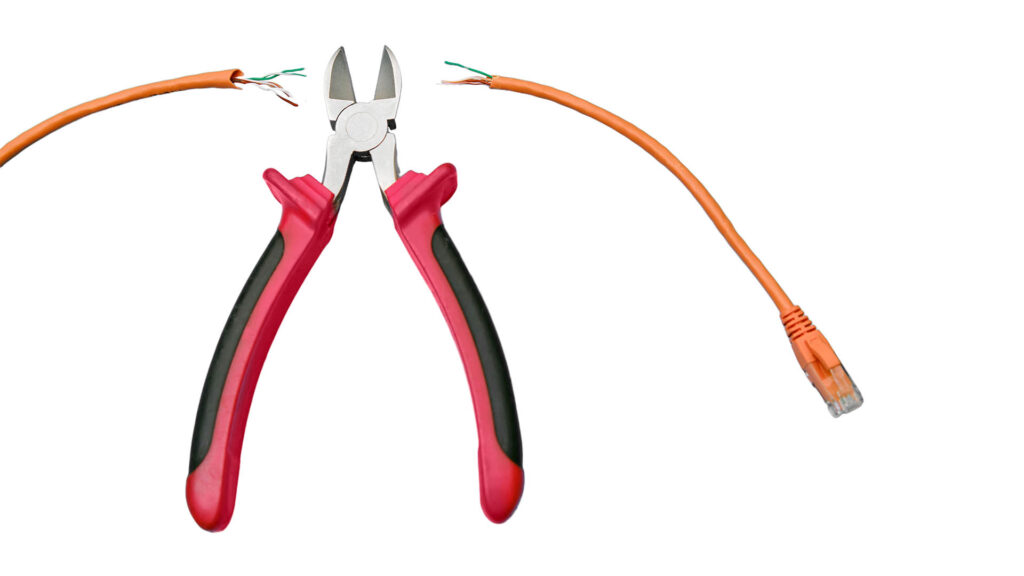

Comcast cuts the cord on cable networks with spin-off plan

Comcast Corporation (NASDAQ: CMCSA) is moving forward with a plan to spin off its cable TV networks, including MSNBC, CNBC, USA, E!, Syfy, and Golf Channel. The decision is part of the company’s broader strategy to reduce its exposure to a traditional cable business that has been losing both viewers and advertisers due to the […]

Comcast cuts the cord on cable networks with spin-off plan Read More »